Share This Article

Vodafone Idea Limited (VIL), listed on the Bombay Stock Exchange (BSE) under BOM: 532822, is one of India’s leading telecommunications companies. The company was formed in 2018 by merging Vodafone India and Idea Cellular to create a stronger player in the highly competitive Indian telecom market. However, the journey since the merger has been riddled with challenges, including intense competition, regulatory hurdles, and mounting debt. This article analyzes Vodafone Idea’s stock, financial health, competitive position, and future prospects.

Compare List BOM Numbers

- BOM:544162

- BOM:500483

- BOM:534816

- BOM:532371

- BOM:543265

- BOM:543228

- BOM:500108

- BOM:537259

- BOM:532944

- NSE:KDL

- TMUS

- SHSE:600941

- VZ

- T

- XTER:DTE

- CMCSA

- NSE:BHARTIARTL

- TSE:9984

- HKSE:00728

- TSE:9432

Company Overview

Vodafone Idea Limited is a mobile telecommunications company that operates under one segment: Mobility Services. Mobility Services generates revenue from mobile services and constitutes most of the company’s total revenue. The company owns communications infrastructure such as fiber networks and mobile towers. The company generates the vast majority of its revenue in India.

- Traded in other countries/regions

- 532822.India

- IPO Date: 2007-03-09

Financial Performance

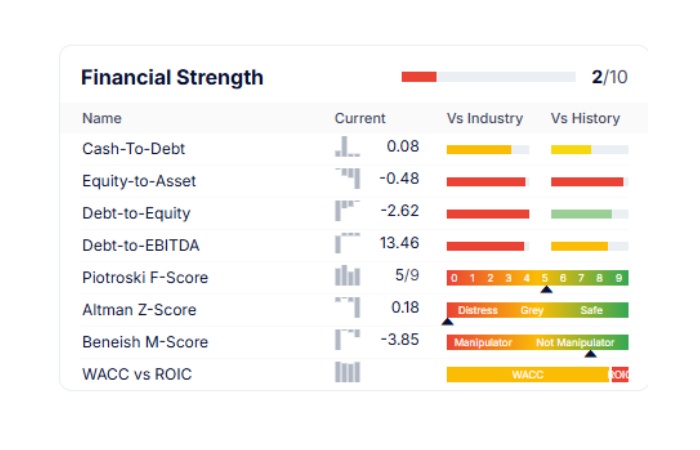

Vodafone Idea’s financial results have been under significant pressure in recent years. The company reported consistent losses, mainly due to the following factors:

Financial Strength

Profitability Rank

Growth Rank

Momentum Rank

GF Value Rank

GF Value Rank

Liquidity Ratio

Regulatory and Competitive Challenges

India’s telecom sector has seen major changes in recent years, with the entry of Reliance Jio in 2016 disrupting the market. Jio’s low-cost voice and data offerings have forced other operators, including Vodafone Idea, to cut prices, leading to marked margin erosion. Moreover, the Supreme Court’s judgment on AGR charges in 2020 has compounded Vodafone Idea’s financial woes, with the company being asked to pay a huge amount to the government.

The competitive landscape remains tough, with Reliance Jio and Bharti Airtel continuing heavy investments in 5G infrastructure and expanding their market share. On the other hand, Vodafone Idea has been slow to roll out 5G due to financial constraints, putting it at a disadvantage in the race towards next-generation connectivity.

Recent Developments

Despite the challenges, there have been some positive developments for Vodafone Idea:

How Vodafone Idea LTD(BOM:532822) Makes its Money

Look into Vodafone Idea LTD(BOM:532822) Cash Flow

Snapshot of Vodafone Idea LTD(BOM:532822)’s Balance Sheet

Stock Performance

Vodafone Idea shares have been extremely volatile, reflecting the uncertainty surrounding the company’s future. Over the past year, the stock has seen significant volatility, driven by news related to fundraising, regulatory developments, and quarterly earnings. While the stock has shown some recovery following government relief measures and successful fundraising, it remains a high-risk investment given the company’s financial challenges.

Future Outlook

Vodafone Idea’s future depends on its ability to effectively execute its transformation strategy. Key factors to watch include:

- 5G Rollout: The company’s ability to invest in 5G infrastructure and compete with Reliance Jio and Bharti Airtel will be crucial. Delaying the 5G rollout could further erode its market share.

- Debt Management: Vodafone Idea needs to continue reducing its debt load through a combination of operational improvements, asset monetization, and possible government support.

- Market share stability: The company should focus on retaining its existing customer base and attracting new users through competitive offerings and improving service quality.

Conclusion

Vodafone Idea Limited (BOM: 532822) is going through a critical journey. While the company has progressed in addressing its financial challenges, the path ahead remains uncertain. Investors should carefully assess the potential risks and rewards before investing in Vodafone Idea. The stock is best suited for risk-averse investors who want to bet on a possible turnaround in the Indian telecom sector. For conservative investors, it may be prudent to wait for more concrete signs of recovery before taking a position in the stock.